12/1/2020 11:18 AM

I love the smell of optimism in the mornings. Today started off with another monster gap up which was to be expected with positive news around stimulus and vaccine.

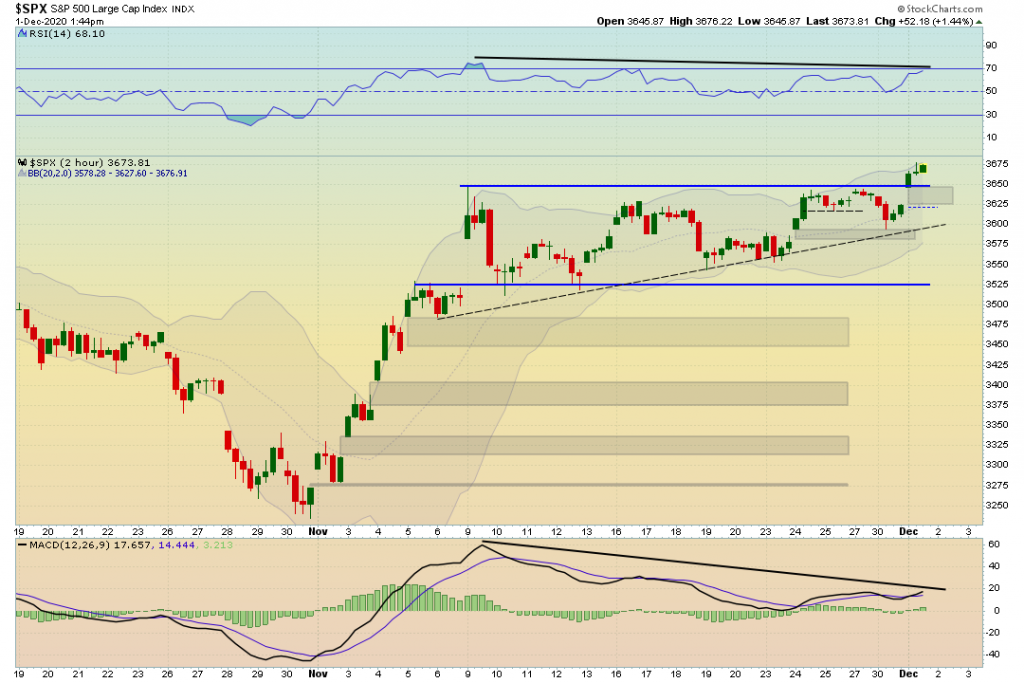

On the charts outlined in yesterday’s Market Brief we talked about the possibility of just gapping over the major areas of resistance in the bullish patterns

The S&P 500 did just that with ease. The question now, is this start of a much larger move to go north of $4000 or a complete fakeout. I will talk more about hat in today’s market brief.

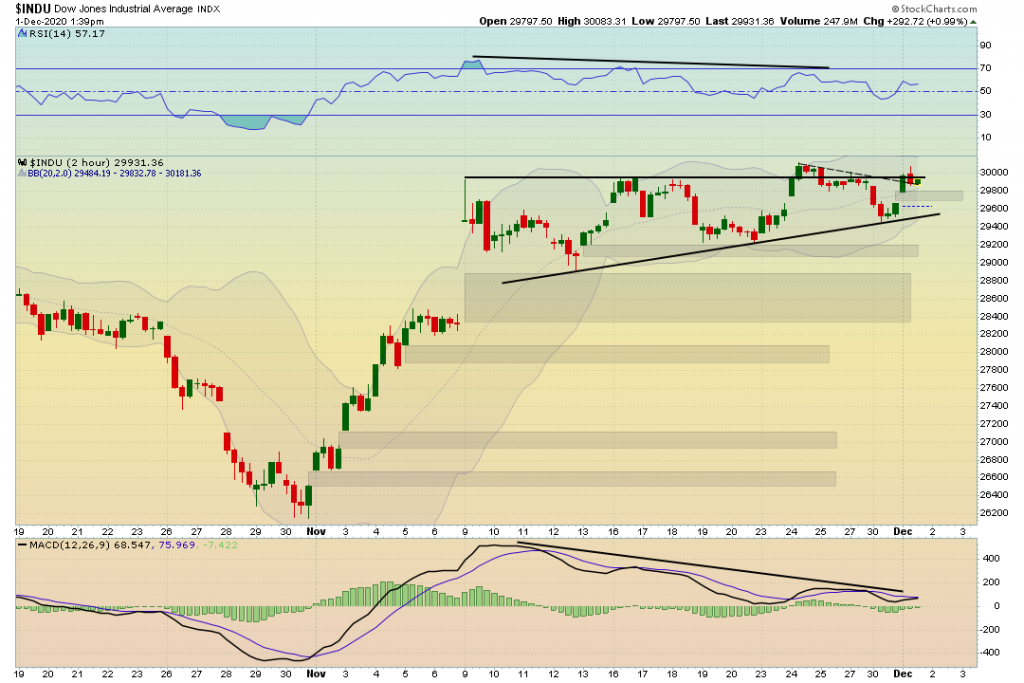

The Dow Jones continues to struggle getting above and staying above $30,000. In order for the other indices to continue to reach new all time highs, the industrials and composite are going to have to break through this resistance.

Other traders are taking notice.

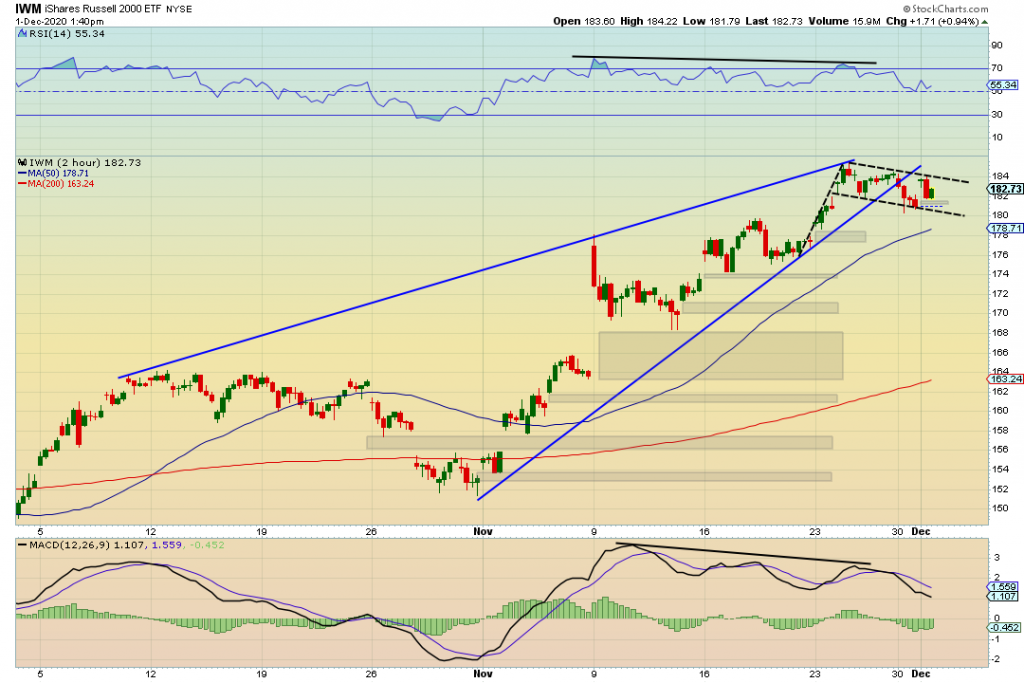

Russell 2000 broke out of the rising wedge pattern but it did so on a day where there was rebalancing taking place. Take not of the possibility of a Bull Flag.

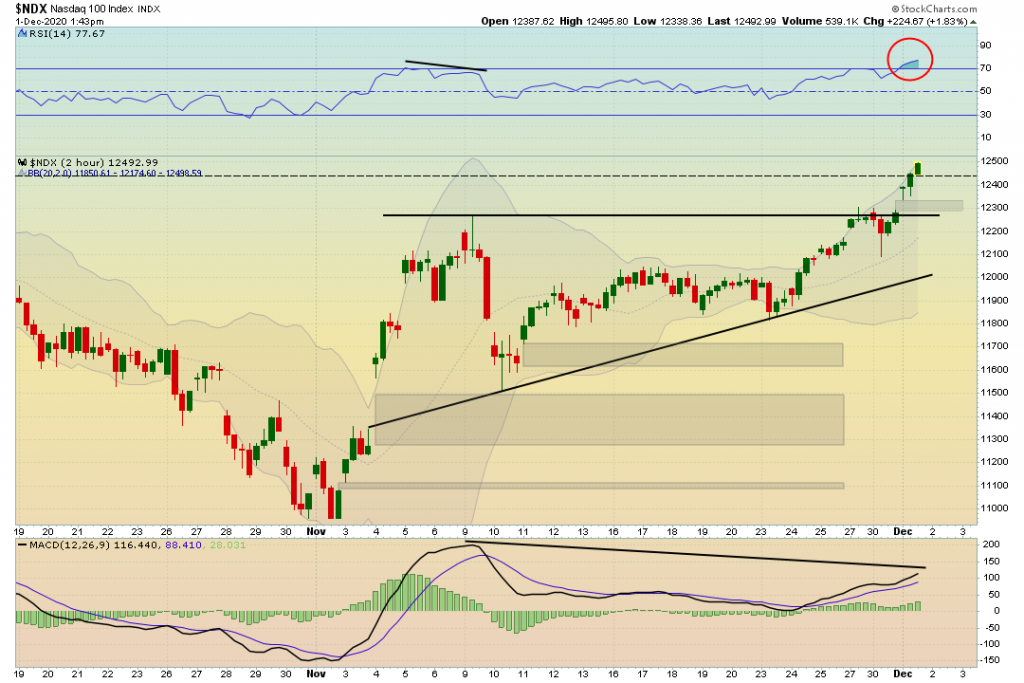

The Nasdaq 100 gapped out of this bullish ascending triangle pattern as well today. The 2 hour timeframe is overbought on the RSI and there is a negative divergence on the MACD.

The VIX (which I forgot to put in yesterday’s market brief) is still holding firm in this falling wedge bullish pattern. That gap that started the February crash just may finally get filled. Maybe even this week, which would launch the markets even to higher levels.

My thoughts: I am not interested in going long here by any means. I still have a small position net long that has been nice seeing some gains, however I am more focused on what the next opportunity is. To me, I belive it will be to the downside. I would expect to be very quick, aggressive, and short lived (at least my position). I have a small short hedge on the IWM, and quite frankly considering bailing from it if we start breaking above $185.

The price action on the monthly timeframes are absolutely bonkers clearing the upper bollinger band and far disconnected from the 5 EMA. This is what happens when the world goes long, and mean that quite literally as global market cap is headed to 100 Trillion!

My personally opinion, stop chasing the dream and start waking up to reality. Make sure your house is in order. Wipe out any consumer debts, take some profits if you are long or at minimum have some stop losses in place.

Come December 21st Tesla will be added to the S&P 500. That will be the largest company added reported bloomberg at $400 billion which is almost 3 times the size of Berkshire in 2010. Tesla is up approximately 40% since the announcement and index managers will be forced to buy it. This might seem like the time to go long Tesla to some, but to me it seems like an opportunity to fade it.

Be careful out there & keep your eyes open.