12/7/2020 11:00 AM

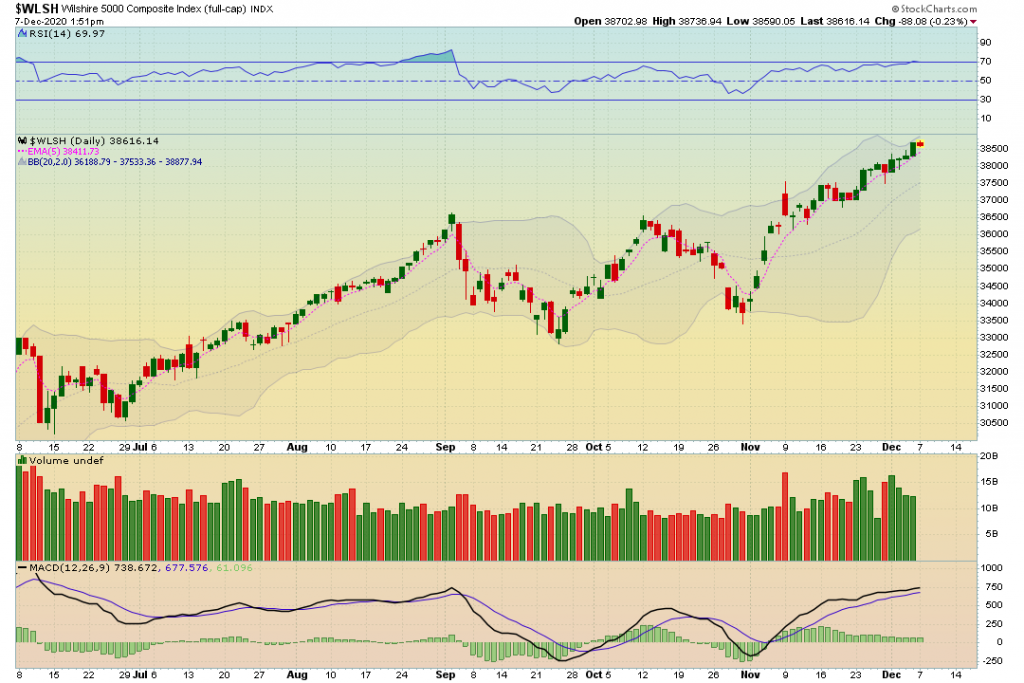

The markets continues to hold very overextended levels based on the various signal charts and indicators I use. Not to mention the Wilshire 5000 pushing and holding sky high levels.

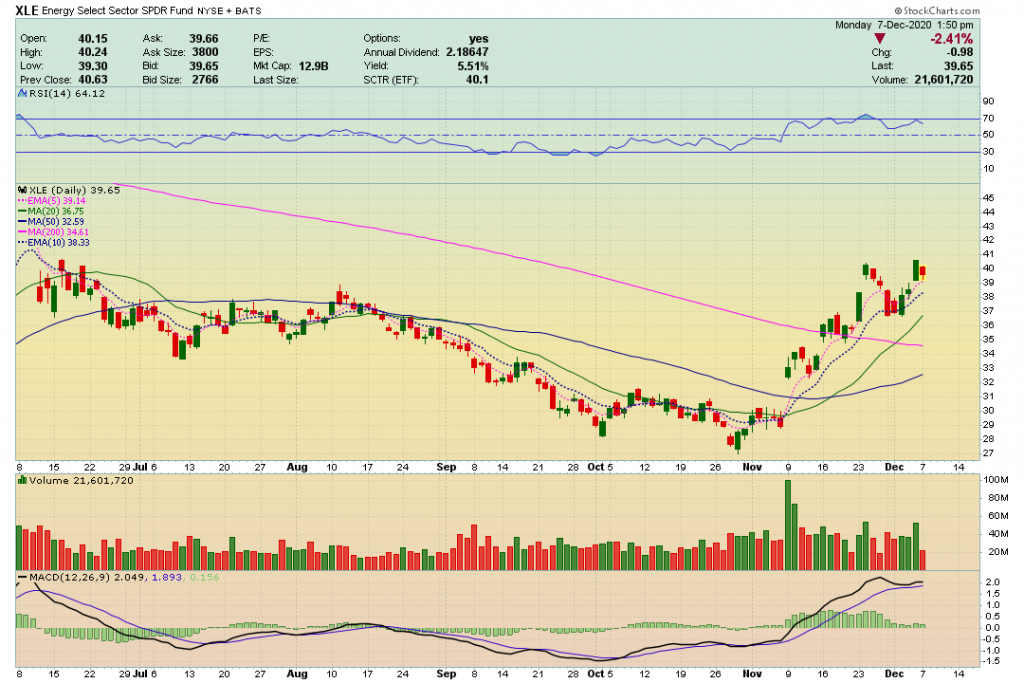

To start the week we are seeing some weakness in energy and minimal strength in Utilities. This can be the start of a new development or really just some profit taking from the energy stocks recent big gains.

Energy sector was one of the brutally beat up sectors over the course of this pandemic and is finally seeing some relative strength. I pointed this out October 7th

The Vix is playing Peek-A-Boo today with the falling wedge. Looks like it ran into the 20 sma and got rejected. Potentially the start of a move higher…But we will see.

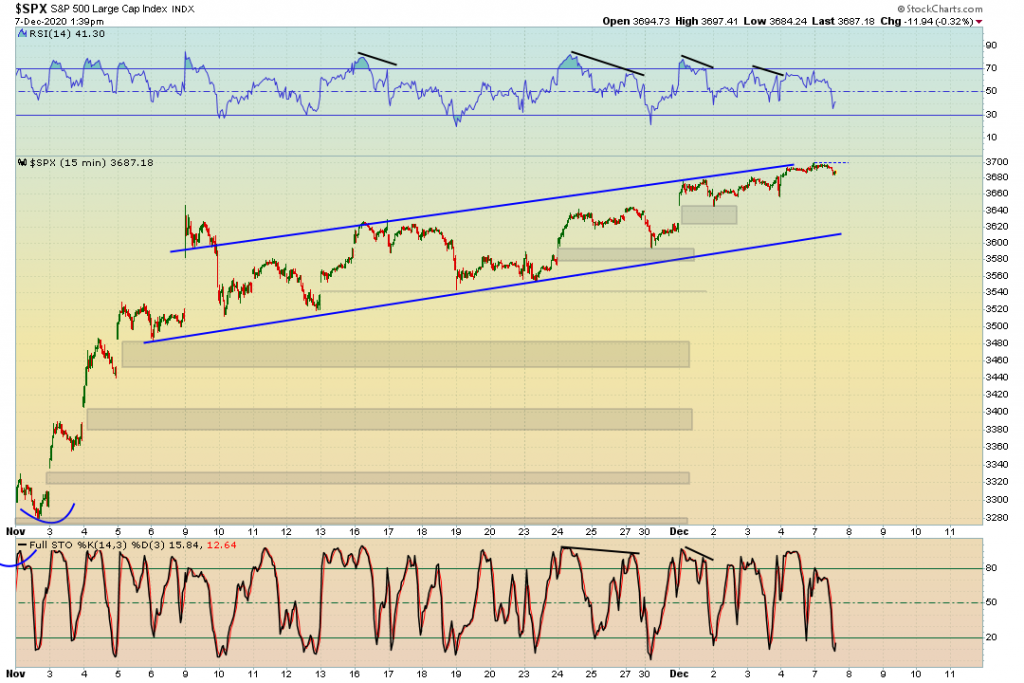

The S&P 500 stochastics is oversold (Which can hold down there for extended periods of time). The RSI has not quite reached oversold territory yet. My best guess would be that we would see price action bounce if we do get a oversold RSI reading. The price action still holding strong at the upper range of the channel as of now. A break above $3700 can very well happen.

Small caps continue to perform very well in this environment. The 15 minute time frame had negative divergence and what we are seeing now is a start of a pullback. Looks like we are finding some support around $188.

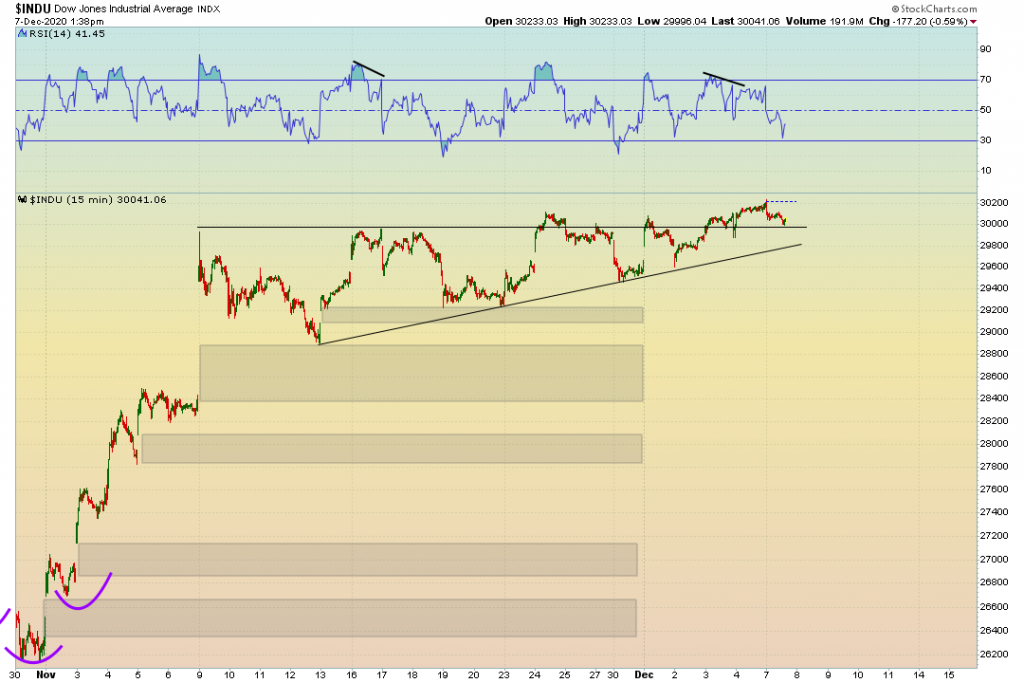

The Dow Industrials today are seeing some very slight weakness, however still holding at / around $30000. Price action is still struggling to really break away from that level.

My thoughts: Its clear that bulls have all the strength here. The market has been pushed higher and higher due to reckless fed policy, unseen market valuations, and insane amounts of euphoria. It might be the easiest time in history to make money. Making money however is a lot different than keeping money. Times like these you need to be patient. Enjoy the gains to the upside, protect yourself from the downside. I personally will be looking for some long setups and reducing my position size. Most of what I am holding is cash, some various long positions and 1 short hedge (on the $IWM) that I continue to reposition.

If you find yourself trying to make a big score here going short, I urge you to be very careful. You cannot outsmart the market.