12/23/2020 9:30 AM

I want to first start of by thanking the many subscribers and viewers that have been engaging with my content. I started posting just about a year ago (12/31/19). Its been a crazy year with over 2.5 million views and nearly 40k subscribers.

I started this as an outlet to share what I learn, to hold myself accountable, and to build more discipline. The best thing about all this is that I love doing it. The hard things is juggling what I love with a full time job and the first half of the year I was also taking classes!

Enough about me, I just really am unbelievably thankful for all of the kind words and support out there in a world that seems to be falling apart.

OK so what is moving the markets!? Futures had it rough last night to begin but started rallying on the news around more stimulus and higher payments to americans ($2000) that are feeling the blunt effect of the wealth inequality gap expanding at an unbelievable speed.

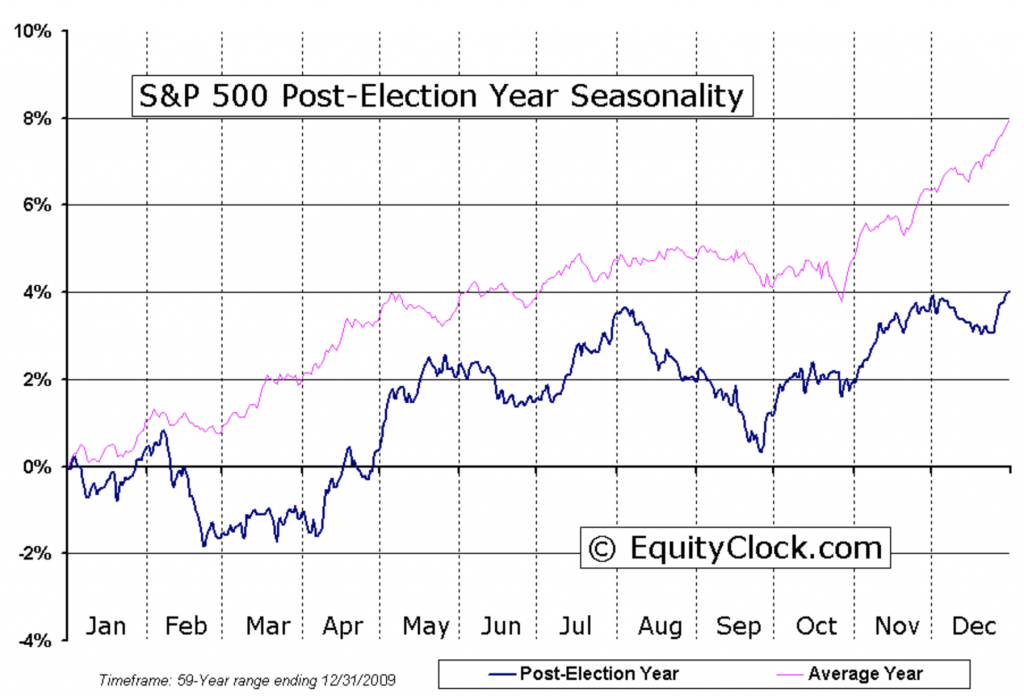

What can we expect for the rest of the year. I would imagine the santa clause rally is still intact giving more stimulus headlines. Being that it is the end of year and holiday season, I would assume the market to drift higher on lower than usual liquidity.

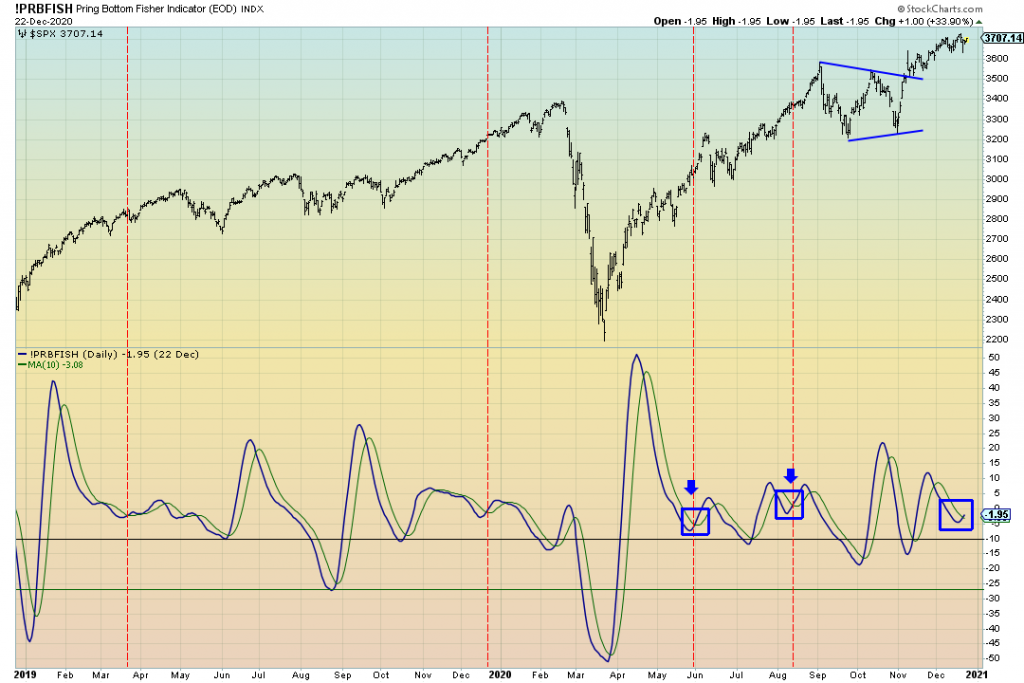

I talked about the Pring Bottom Fisher in last night’s brief crossing over the 10 sma. the last 2 times this happened we saw a big time short squeeze and then a complete correction. This makes sense and lines up with the post election seasonality charts.

The “Sell Signal” chart turned back a little bit yesterday, the sell signal will get triggered when the black line (10 SMA) crosses above the red line.

The S&P 500 on the 30 minute time frame broke out of the bull flag as discussed on yesterday’s stock market brief. We are now working on closing the gap overhead. If we clear that the target can his 3750 – 3780.

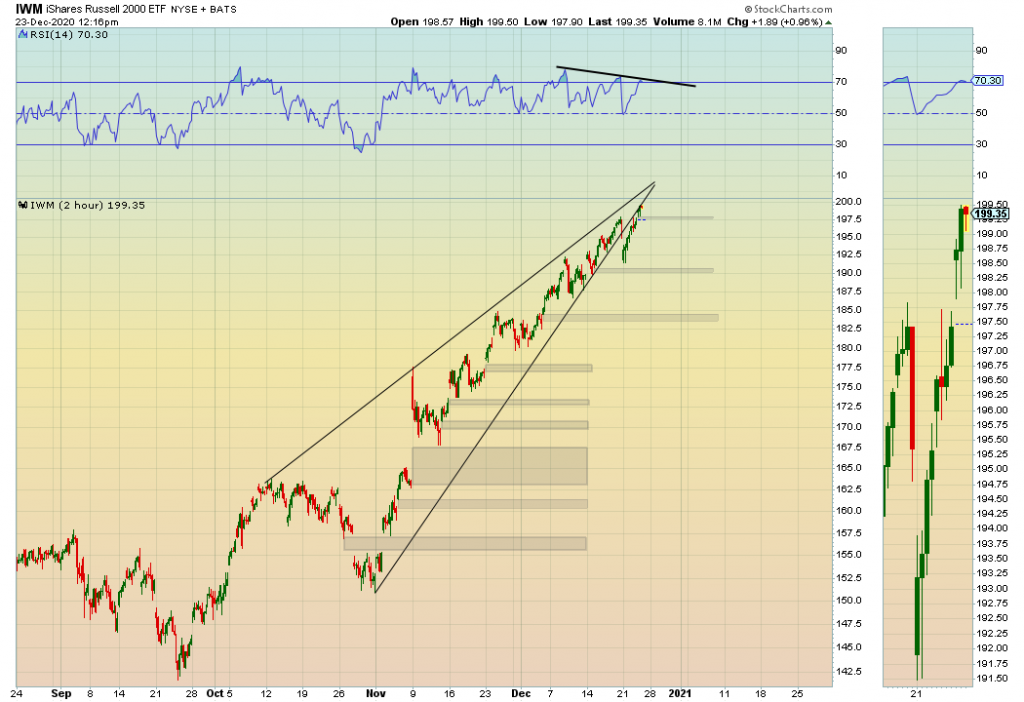

The Russell 2000 hit another all time high. It did so on a negative divergence on the 2 hour timeframe. Incredible moves in small caps. I personally will be using the IWM to hedge my long positions. I will not be going long at these extended levels moving into the end of the year.

Final thoughts: Unless we get some sort of rug pull news the market is poised to follow the santa rally script. I personally do not like the stress of big positions during the holidays. I am mostly cash and I have my core positions in commodities (Gold & Silver). There is to much of a case to be built for a quick correction, and a rip higher. My head feels like a doji candle, so i position my portfolio as such haha.

2021 is right around the corner and the market is definitely on a path to reach incredible new highs. But remember it will do so with some extreme pull backs and corrections. So my plan going into the new year is to remain very tactical and play over extension from both a long and short perspective.

HAPPY HOLIDAYS EVERYONE. I am looking forward to recording my live trades again come 2021!