11/9/2020 10:43 AM

Wowza! “Unprecedented” continues to be the most used word in 2020. The stock market reaches an all time high albeit another MONSTER gap up. The bulls are having a massive celebration right now around this positive vaccine news.

What will happen next? nobody really knows, so if you hear “experts” talk in terms of certainty in an environment thats completely new to people, take it with a grain of salt.

Lets take a look at some of the technicals.

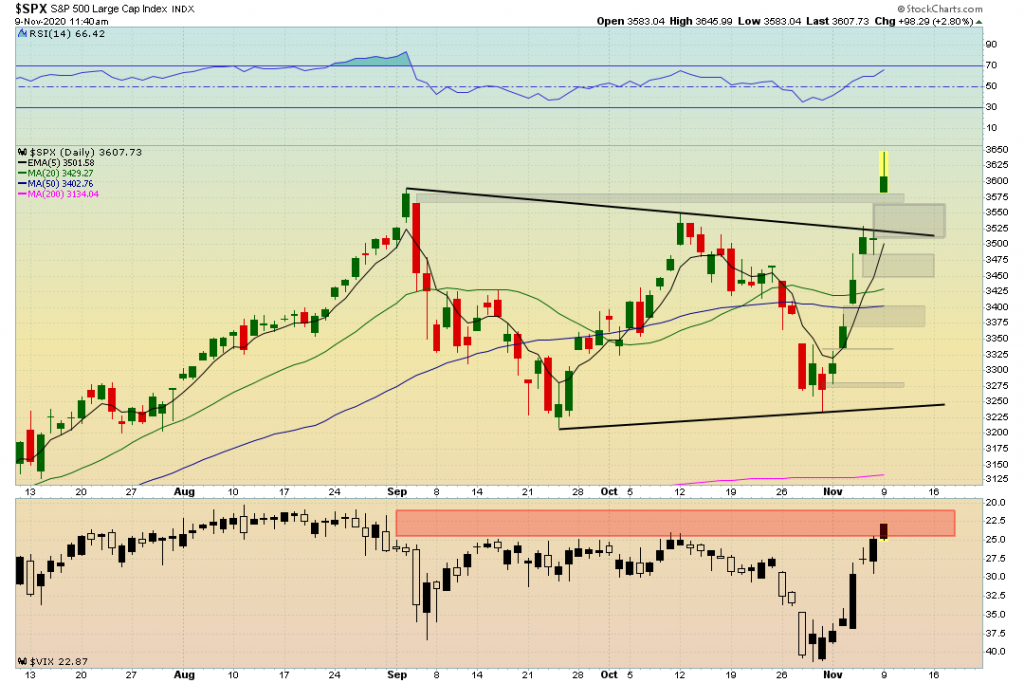

The S&P 500 gapped above the all time market high and that stubborn trendline. This could be setting the stage for a reversal candle, but we still have much more time left in the day. Bulls might be having a field day right now, buts its safe to say that the last week of trading is setting the stage to make the bears very happy as well. Huge gap ups and vertical movement’s further extending from the 5 EMA. Im happy to not be a part of this.

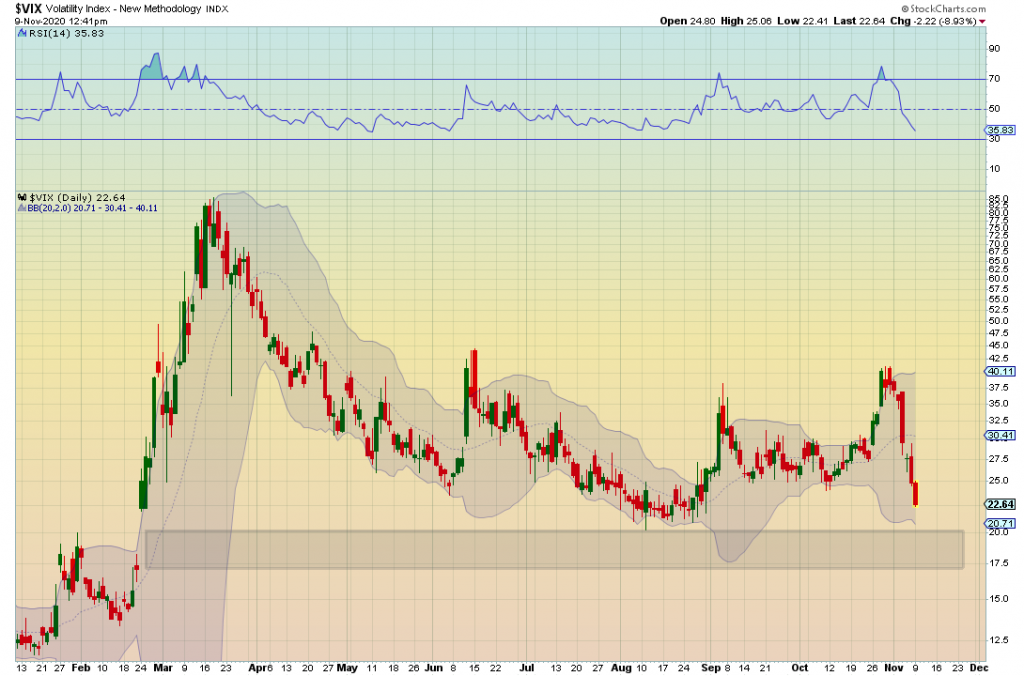

The VIX inverse Head & Shoulders is no longer. Now my eyes are on the gap from mid February and the lower bollinger band.

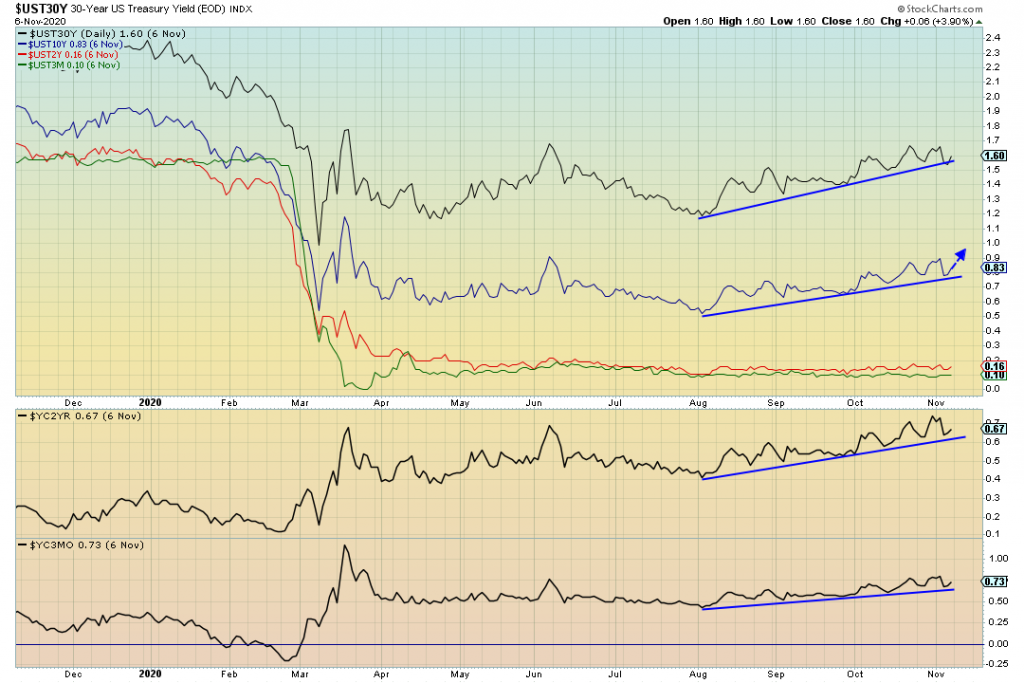

Look at the 10yr Yield! Up 17% today

When yield go up, that is good for the banks. Take a look at the regional banks. The stubborn resistance was just now broken and the inverse H&S is currently playing out.

The bonds got stuck up at the resistance and broke down from from the lower trendline we mapped out on the last stock market brief.

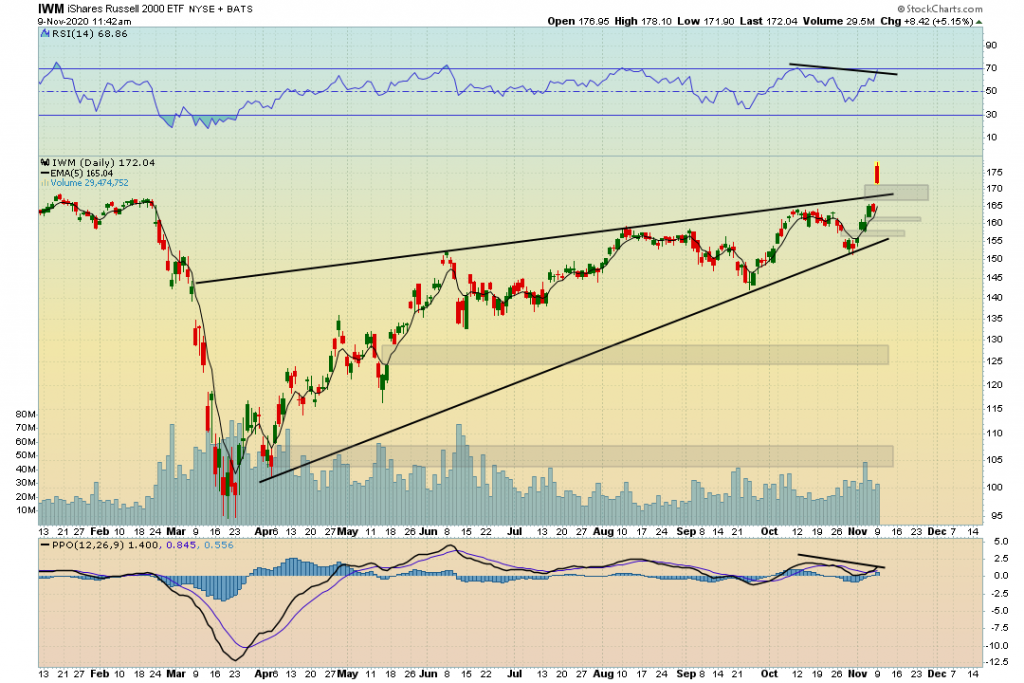

The Russell 2000 is setting the stage for a large reversal type candle. Its to early to tell if this move has more legs in it.

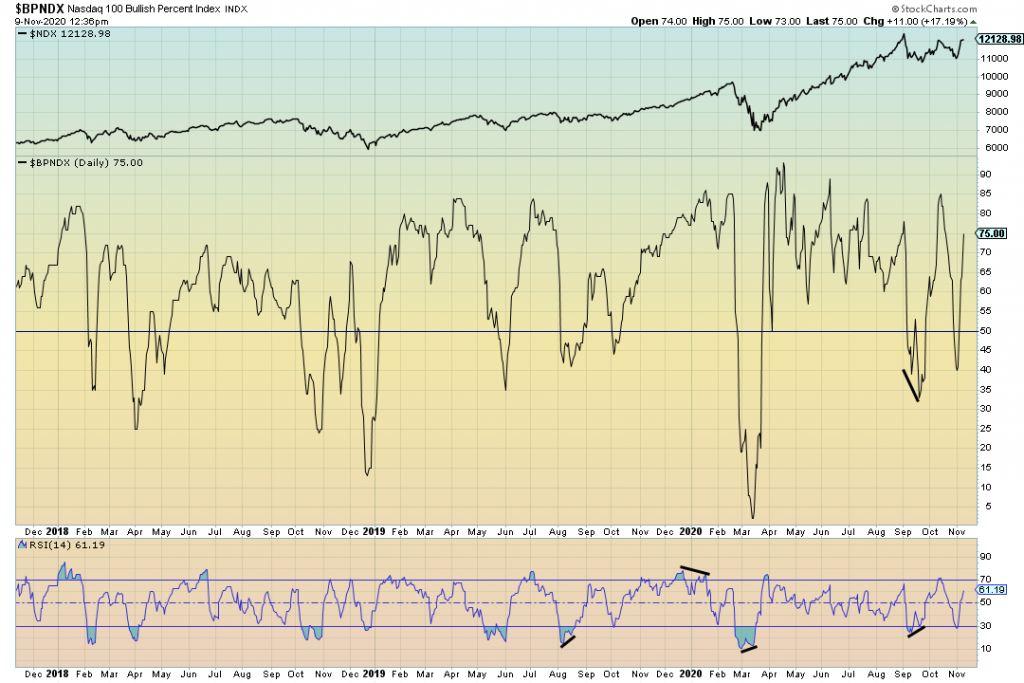

The BPNDX among other indicators are still showing the possibility that there is more room to run in this rally. The danger here remains with all the open gaps and insane vertical movement to the upside.

To wrap up my thoughts here, I am happy to not be a part of this insane price action. Part of me is sad for missing a big move, but another part of me couldn’t care less. Some of the indicators as stated are still not overbought which suggest this move might NOT be over. All the gaps up leads me to believe that there has been an insane amount of short covering. Once the gas is out of this tank, we can witness some extreme moves to the downside. Moves like this in the market are not typical, so if you benefited from the monster rally, don’t become complacent. Bad news can strike at any moment, and the market is setting the stage for some big time volatility.