11/16/2020 10:30 AM

It doesn’t get much more bullish than this. The market opened up again with another rather large gap up across the indices. What do we do from here? What can we do? Well, there’s only a couple things to choose from..

- Don’t do anything

- Buy into this mania

- Sell into this mania

From a technical perspective, the charts are really moving into some over extended territory. However there are some charts (as discussed in the previous market briefs) that lead me to belive the market definitely had more room to run.

Market action like this requires patience. The thought “I missed the move” will be running through millions of peoples heads which causes people to be reactive in an environments where they should be proactive.

Lets look at some charts.

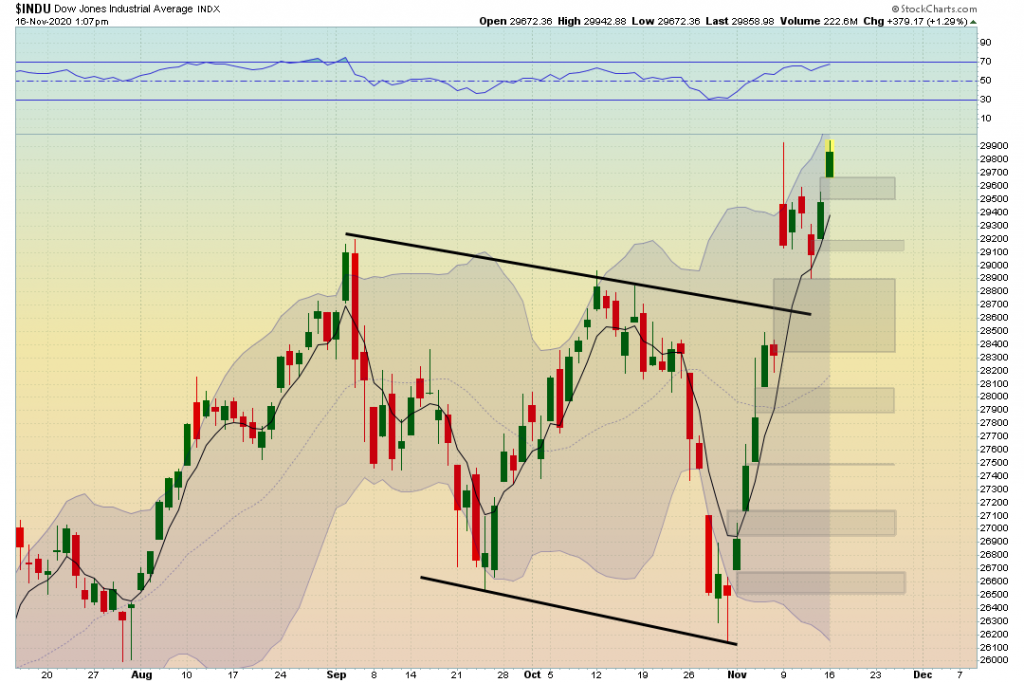

Dow Jones continues to move completely vertical somewhat creating a double top right around a round psychological number ($30,000). Make no mistake, moves like this do not last forever. Markets are very good at sucking people in at the very wrong times.

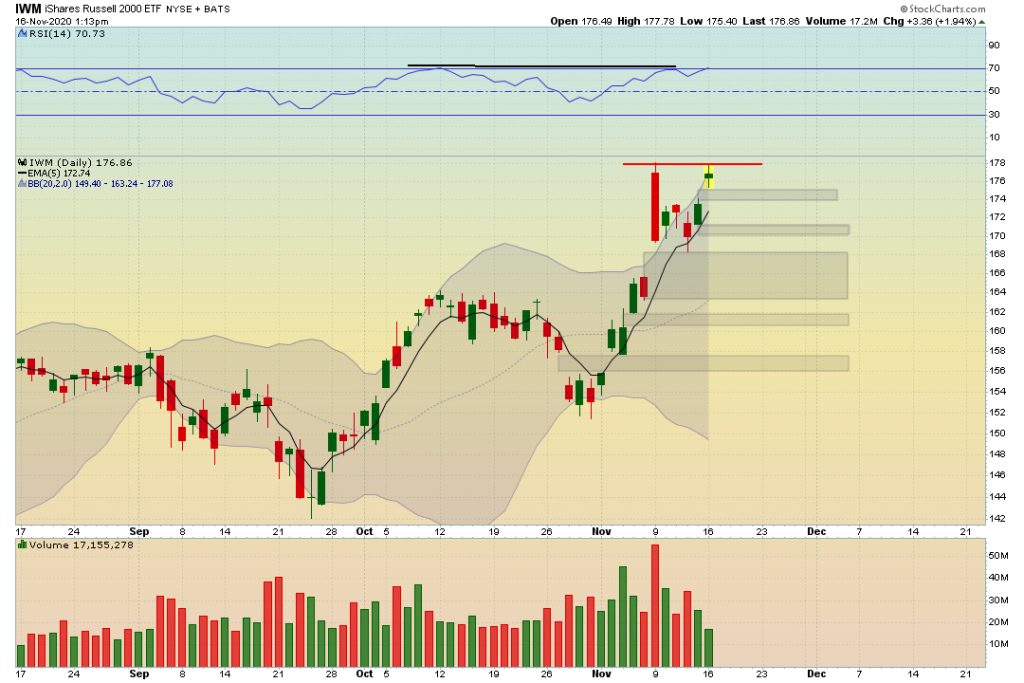

The Russell 2000 creating a double top on the daily timeframe and also running into the upper bollinger band. Goes without saying that there is nothing but gaps propelling this market up. Gap & Camp is the new norm these last couple weeks.

This is the 30 minute timeframe of the S&P 500. The chart should look familiar. It was pinned within a range and finally broke out to the upside (of course with a gap). It slightly pushed into overbought territory and seems to be slightly rolling back over. Perhaps it will fill the gap on a back test and continue to push higher…Or maybe turn around tuesday will surprise us.

The VIX is range bound within a bear flag pattern. Perhaps it will break down and fill the stubborn gap below us. I personally think looking at various timeframes the VIX is due for a rip to the upside in the very near future (Atleast back to the upper part of the current channel (27.5).

As it stands for me, still placing no trades until there is more extremes met. I hate to have patience while the market blows to all time highs. When I start feeling emotional, or have a feeling of missing out, all I do is think back to the March crash and how it quickly ripped through 4 years of gains.