Lots of green on the screen today, but the larger market cap names made it difficult for this market to get some continued traction.

This had to happen eventually as names like NVDA, MSFT, META had been going straight up. (pictures below),

Today we received some highlights in terms of news and economic data, and we have important data coming out on Thursday. Remember, Thursday is a shortened trading session, and the market is closed on Friday.

US Senate Passes Trump’s OBBB

The US Senate narrowly passed former President Trump’s OBBB bill in a tight 50-50 vote, broken by Vice President Vance. The bill now advances to the House Rules Committee before reaching the House floor, though concerns remain around the Senate’s Medicaid provider tax crackdown, which faces resistance among House Republicans.

Robust JOLTS Report Signals Strong Labor Market

The May JOLTS report surged to 7.769 million, significantly exceeding forecasts (7.3 million). The quits rate rose slightly to 2.1%, indicating job market confidence, while the vacancy rate climbed to 4.6%. Despite the strong numbers, Oxford Economics noted hiring remains subdued but layoffs are low, suggesting no immediate inflationary pressures from wage growth. Consequently, the Fed is expected to maintain its cautious stance, with market speculation shifting toward a potential rate cut in December.

ISM Manufacturing PMI Shows Mixed Signals

The ISM Manufacturing PMI edged up slightly to 49.0, surpassing forecasts but still in contraction territory. Key components showed prices paid rising unexpectedly, while employment dipped further into contraction. Respondents consistently highlighted tariff uncertainty as significantly disrupting business activity and investment decisions.

Powell Maintains Open Mind on July Rate Decision

Fed Chair Jerome Powell, speaking at Sintra, refrained from ruling out any actions at the upcoming July meeting. He reiterated the Fed’s data-dependent approach, mentioning the economy’s strong overall health and inflation nearing target levels. Powell’s cautious tone was initially interpreted as dovish but was largely viewed as non-committal.

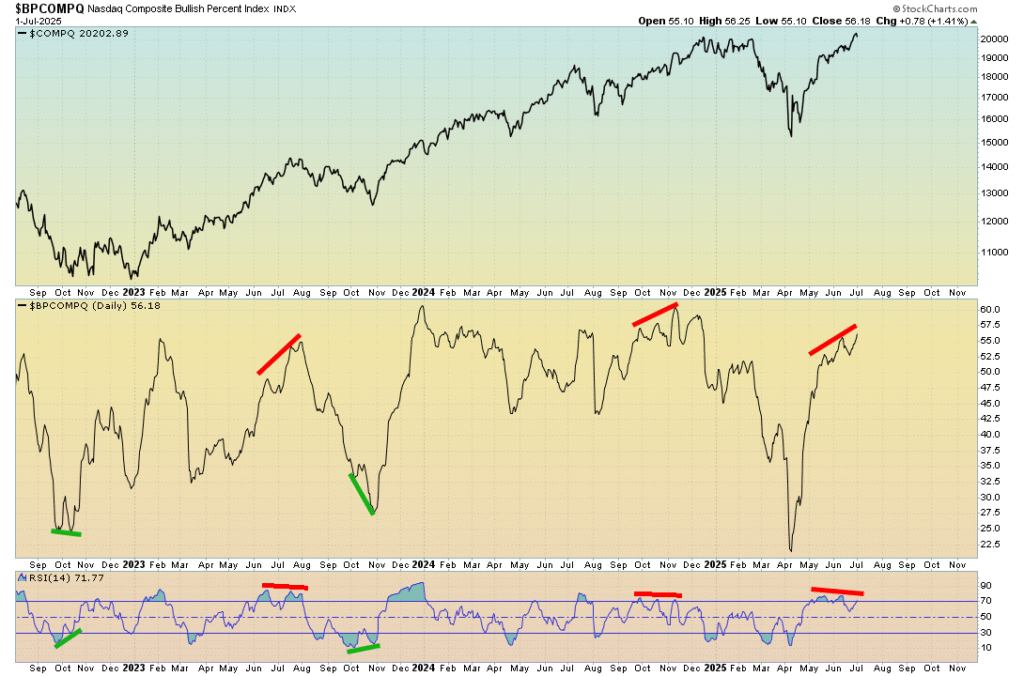

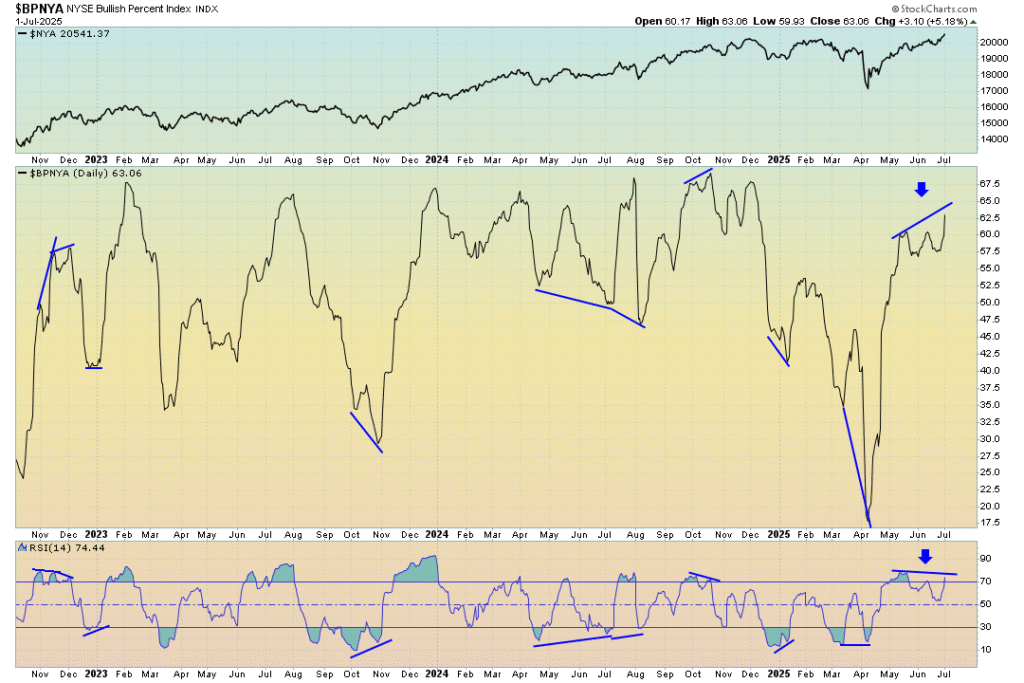

Signal Charts

Things have been getting frothy in the markets. Here are a couple Bullish Percent Charts with bearish divergences that are still building out.

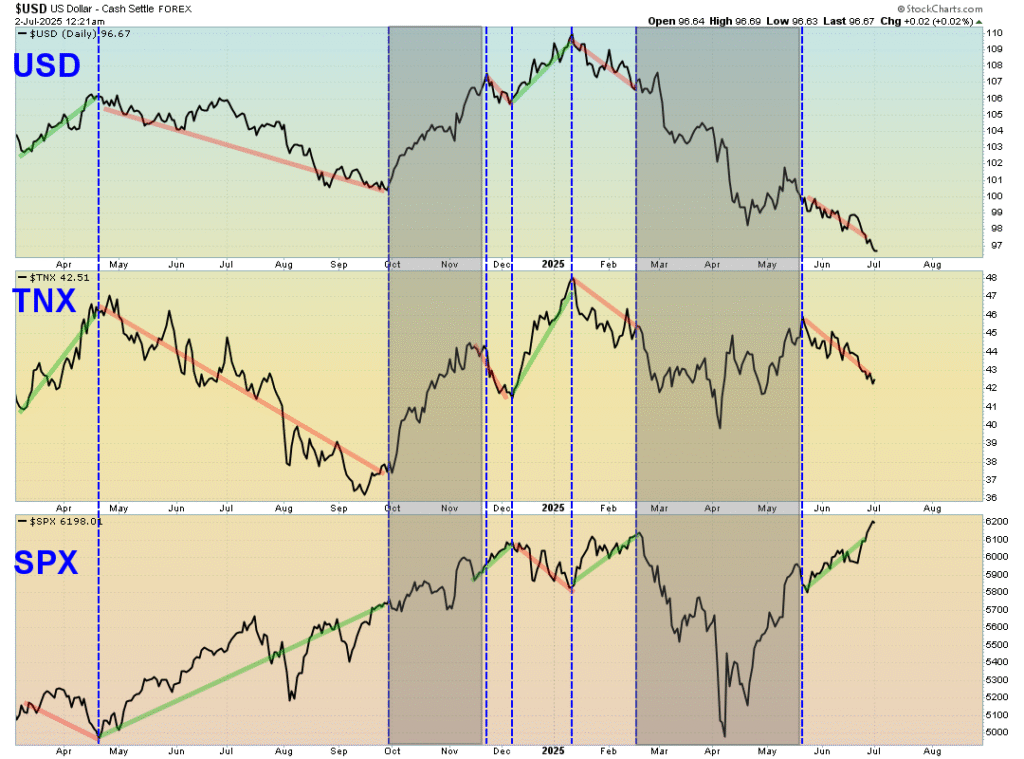

Intermarket

I’ve been sharing this chart frequently because, if you look at the right side, you can clearly see why the market has been ripping higher and higher. We’re seeing a falling dollar and declining 10-year yield. Right now, that’s a very strong negative correlation and should be monitored closely.

Why, you ask? Simple. The dollar is currently in a bearish trend; however, it’s been forming a bullish divergence and appears ready for a countertrend bounce.

Market Conditions

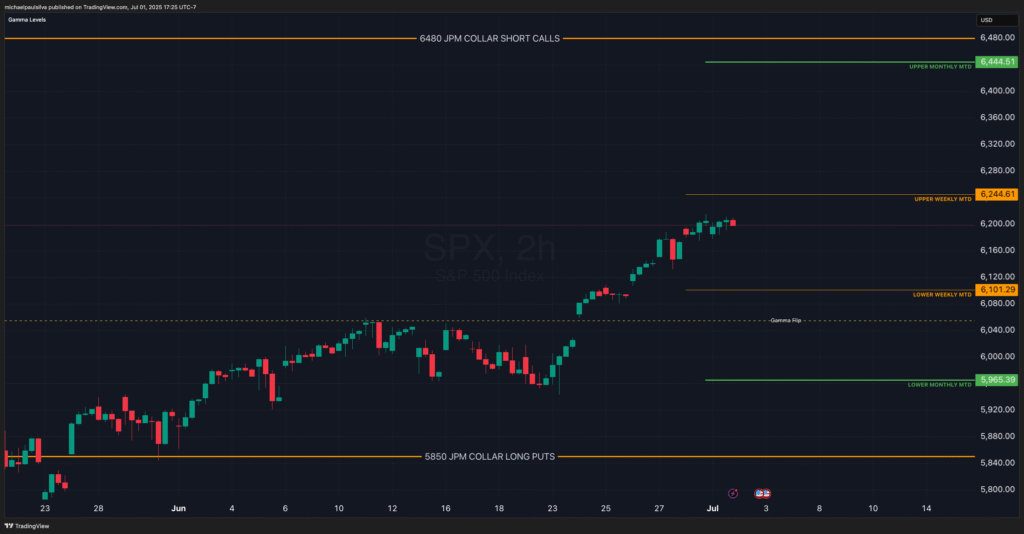

We still have the SPX trading above the Gamma Flip Line (6055). So, this is the environment I prefer swing trading. Volatility typically subsides, liquidity increases, and dealers look to buy the dip and sell the rip.

With that said, I’m still looking to add swing-trading exposure in various names that are setting up. In last night’s Market Brief video, I discussed several of these setups. Check out the video below and skip to the end if you want to see some names that are currently on my radar. Personally, I’ve recently initiated new positions in Starbucks (SBUX), Mondelez (MDLZ), and Papa Johns Pizza (PZZA). There are others im stalking as well

Expected Moves

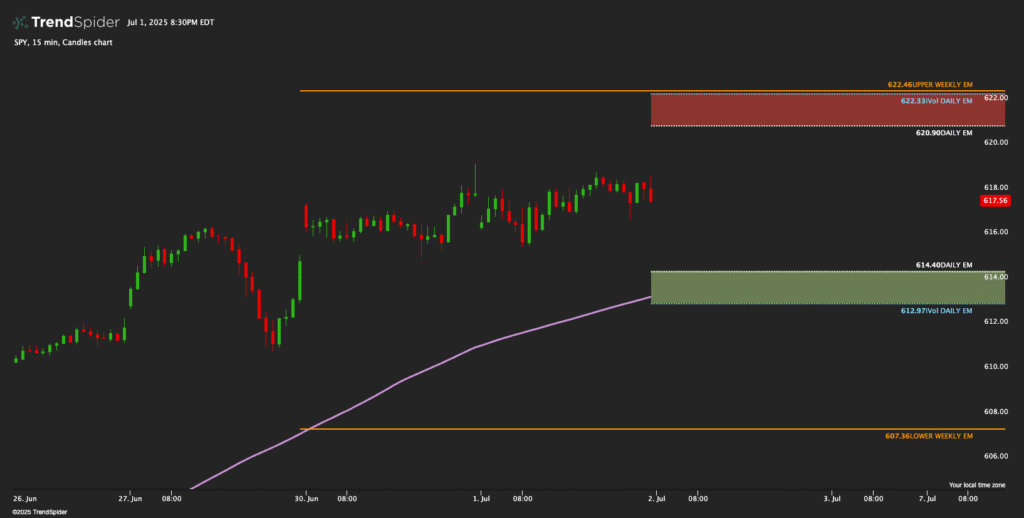

The picture below shows SPY (S&P 500) on the 15-minute timeframe with highlighted expected moves. The red and green zones represent the daily expected move, while the orange lines indicate the weekly expected moves. We’re still trading above the synthetic, rising 5DMA, but price action has recently stalled a bit.

Conclusion

Overall, I’m bullish, but with a very heightened sense of caution in the near term. Given that the SPX remains above the gamma flip line, I’m still focused on swing-trade setups that are contracting and tightening, clearly outlining my risk. I’ve started to notice that some overlooked names have begun attracting attention today, which is encouraging since I’ve initiated positions in several of those names I mentioned earlier. Whether this momentum holds, I can’t say for sure. However, I’ll be patiently watching to see how the big tech names consolidate and if they build strong bases. I’ll also be closely monitoring those forgotten names that have been quietly basing. When market conditions shift toward shorter-term holds, I’m sure I’ll be among the first to mention it. Until then, always prioritize risk management and remember, this isn’t a race or a marathon; it’s a challenging job that never ends haha